20+ Mortgage points cost

A mortgage point typically equals 1 of your total mortgage amount. Learn how mortgage points can help you pay less for your home.

The Spread Between 30yr Mortgage Rates And The 10yr Treasury Is Blown Out To Levels Only Seen In 2009 And 2020 Fed Pivot Inbound Imo R Wallstreetbets

On a 100000 home three discount points are relatively affordable but on a 500000 home three points will cost 15000.

. Each mortgage point costs 1 of the total loan not purchase price. The average 20-year refinance APR is 5970. If you have a 200000 mortgage each point would cost 2000.

Mortgage discount points are all about playing the long game. For example if youre borrowing 100000 1 of that one point equals 1000. Another way to think of it is that one point equals 1000 for every 100000 of the loan amount being.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Each point usually costs about 1 of the loan amount. Points cost 1 of the balance of the loan.

As mentioned above one mortgage point is equal to one percent of the loan amount. If a borrower buys 2 points on a 200000 home loan then the cost of points will be 2 of 200000 or 4000. Lock Your Rate Now With Quicken Loans.

How Much Do They Cost. Origination points and discount points. Ad Protect Yourself From a Rise in Rates.

Better Money Habits can help determine if buying discount points makes sense. As the cost of a point is based on a percentage point of your mortgage the larger the mortgage the more it costs to buy a point. There are wide variations in the.

1 day ago20-year fixed mortgage rates. The cost of a mortgage point is equivalent to 1 of the total mortgage amount. After five years with the 40 home loan youll have paid 76370 in interest payments plus 8000 in mortgage points for a total of 84370.

Current 20-year mortgage rates. Origination points typically cost 1 percent of the total mortgage. In other words if you take out a 1 million mortgage and buy one point for 100000 you can only deduct 75000 1 times 750000.

A single mortgage point or just a point is equal to 1 of the amount you borrow. On Wednesday August 31 2022 the national average 20-year fixed mortgage APR is 5970. The longer you plan to own your home the more points can help you save on interest over the life of your loan.

5625 down from 5750. Youll have reduced your. Apply Today Save Money.

For example on a 200000 loan each mortgage discount point is 2000. With points rising to 071 from 068 including the origination fee for loans with a 20 down payment. However each lender is allowed to set its own prices.

The extra expensepaid on the. When you pay this fee the lender. Its important to understand what mortgage points are when seeking a loan.

Your up-front mortgage points. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The size of the loan will have a considerable impact on the total cost of refinancing.

Make lenders compete and choose your preferred rate. Do you want to buy a house or apartment with lower upfront costs. Three points will cost 15000.

So if a lender charges 15 origination points on a 250000 mortgage the borrower must pay 4125. Compare up to 5 free offers now. So a point for a home loan of 200000 would be 2000.

How to calculate mortgage points. On top of the traditional 20 down payment of. With an average loan amount of 453000 youll probably spend at least 30007000 buying points.

On a 200000 loan 1 mortgage. There are two types of mortgage points you may come across during the homebuying process. Ad Get mortgage rates in minutes.

Using the typical range of 2 to 6 percent of the loan amount closing costs for a. In both instances the cost of a. Rates for a 15-year mortgage are more than half a point lower than 30-year terms which tend to be the most.

Were Americas 1 Online Lender. 2 hours agoThe rate on the 20-year fixed mortgage increased to 566 from 555 the week prior according to Freddie Mac and is up more than a half-point from two weeks ago. Ad Compare the 10 Best Mortgage Quotes From Top Lenders.

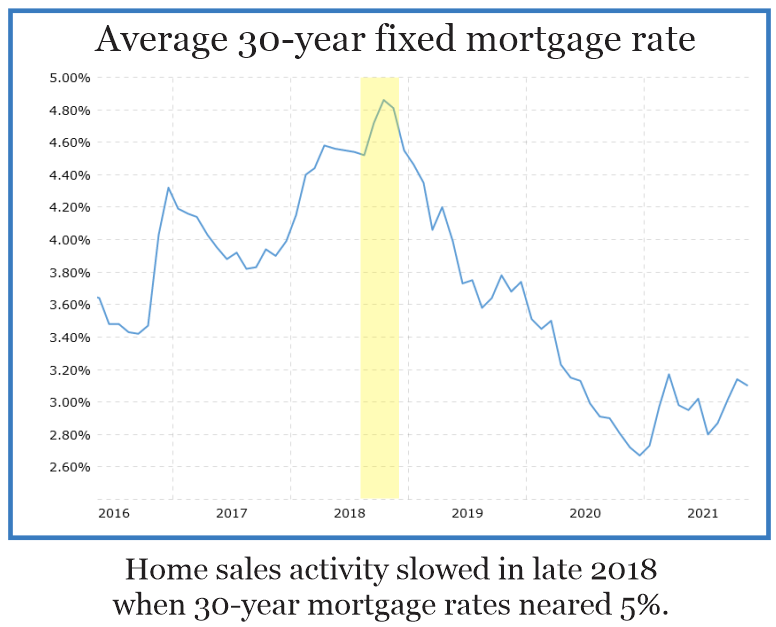

1 day agoThat caused mortgage demand to pull back even further.

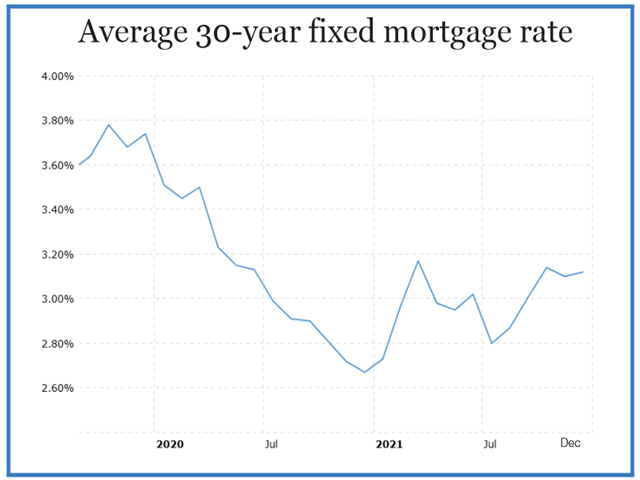

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

Fixed Vs Variable Rate During Increasing Rates Canadian Money Forum

Did The Fed Lower Interest Rates Too Much And For Too Long Federal Download Scientific Diagram

How To Hedge Your Bets Once You Ve Realized A Mistake Was Made

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

Sample Rate Sheet Day Refers To The Lock Period All Entries Are Download Table

Downloadable Free Mortgage Calculator Tool

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

How Mortgage Loan Prices Are Determined By Lenders Mortgage Capital Trading Mct

Downloadable Free Mortgage Calculator Tool

/basis-point-4200871-final-391aeb3bbde44238b509a838954d6e77.png)

Basis Points Bps Explained For Interest Rates And Investments

Piti The Cost Of Owning A Home

Best Mortgage Lender First Time Buyers Financial Samurai

Trigger Rates The Next Dominos To Fall R Torontorealestate

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

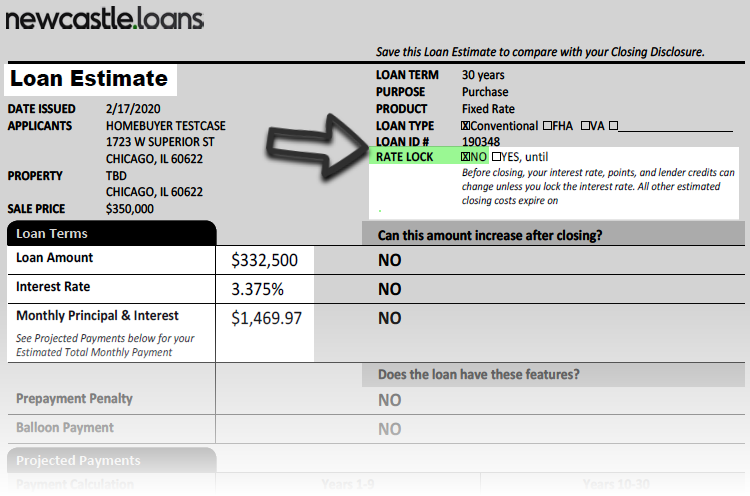

How To Lock In A Low Mortgage Rate